What is a VA Home Loan?

A VA Home Loan is a type of loan which is backed by the government for eligible veterans, active duty service members, surviving spouses, and eligible National Guard and Reserve service members. These loans are based on the GI Bill of Rights, which started the VA home loan program in 1944. This is the program that allows the government to back or insure these loans against default. The original goal of the program was to help WWII veterans to be able to afford homes after returning from war. This program has been extended over the years to benefit the men and women who have served in the armed forces of our nation in war and peace following WWII, up to those who are currently serving.

Who is Eligible?

The VA sets requirements to define who are eligible veterans, active duty service members, surviving spouses, and eligible National Guard and Reserve service members. We’ll cover a summary of the current rules below, but keep in mind that the VA can update their requirements and you may need to look up information regarding your specific eligibility, so double-check with their website for the most current information and additional details.

Keep in mind that in addition to your eligibility for a VA Home Loan, lenders will also be looking at your income, credit history, debts, and assets to determine your overall eligibility for a home loan. These factors will impact how large of a home loan you may be eligible for and other factors like interest rates.

Active Duty Service Members

For current active duty service members, the requirements are simple. You need to have served at least 90 continuous days in active-duty service to qualify for a VA Home Loan.

Veterans

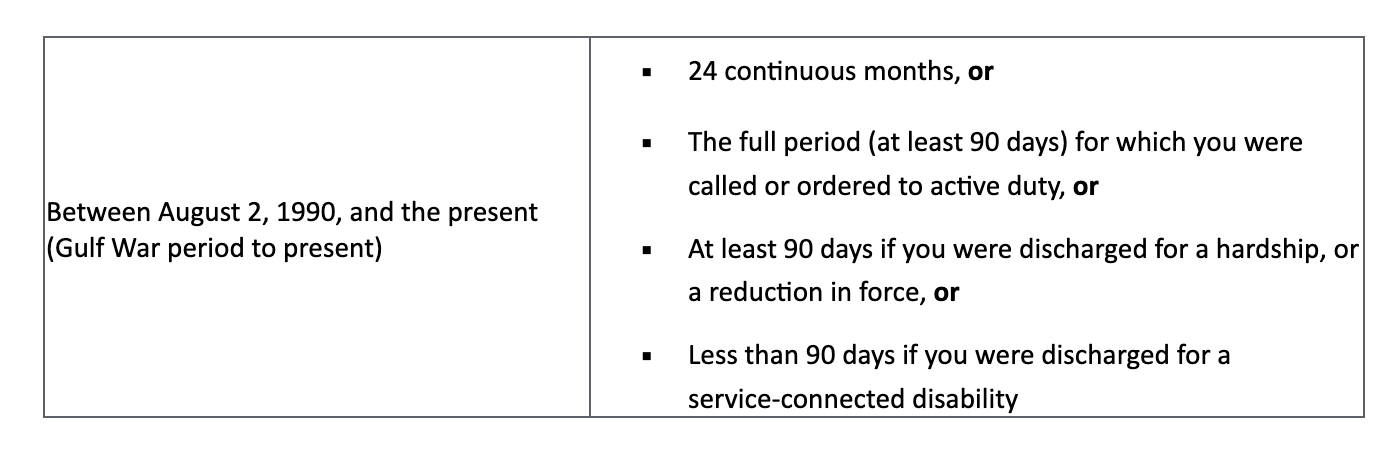

For veterans, the requirements for length of service are a bit more complicated. The dates of your service; whether you were an officer or enlisted personnel; and whether you were discharged for a service-connected disability all impact the length of service which is required to be eligible for a VA Home Loan. For most dates of service, the requirements range between 90 days to 24 months, barring service-connected disability, which typically shortens the required term of service.

The VA’s website makes it easy to check your specific requirements. Their chart is organized by date of service, with the information regarding that period organized under that heading. The information below is an example drawn from the VA’s website, regarding veterans who served between August 2, 1990 to the present, to show you how the chart is set up.

Surviving Spouses of Service Members

Surviving spouses have their own set of requirements. To qualify to get a VA Home Loan, the first step is to obtain a Certificate of Eligibility (COE) from the appropriate government department. To get this form as a surviving spouse, you would need to meet one of the following requirements taken directly from the VA’s website.

At least one of these must be true:

The Veteran is missing in action, or

The Veteran is a prisoner of war (POW), or

The Veteran died while in service or from a service-connected disability and you didn’t remarry, or

The Veteran died while in service or from a service-connected disability and you didn’t remarry before you were 57 years old or before December 16, 2003, or

The Veteran had been totally disabled and then died, but their disability may not have been the cause of death (in certain situations)

Note: A surviving spouse who remarried before December 16, 2003, and on or after their 57th birthday, must have applied no later than December 15, 2004, to establish home loan eligibility. We’ll have to deny applications we received after December 15, 2004, from surviving spouses who remarried before December 16, 2003.

The VA’s page for home loans for surviving spouses also contains links to the different forms that you would need to fill out in order to get a Certificate of Eligibility (COE).

National Guard and Reserve Service Members

In some cases, you may qualify for a VA Home Loan as a National Guard member or a Reserve service member. In both cases, there are requirements regarding dates of service and length of service, whether that is active duty or creditable years with the organization before an honorable discharge. Generally, though you need to have served 6 years to have enough service to qualify.

What Are the Benefits?

While this may seem like a lot of paperwork and details to sort out, the benefits of a VA Home Loan can make it worth pursuing.

One of the top benefits is that, in most cases, you do not need to have a down payment and you will not have to pay mortgage insurance. For most conventional home loans, lenders require at least a three percent down payment towards the home’s price, and mortgage insurance, if the down payment is less than 20 percent of the home’s price. With a VA home loan you can bypass those requirements, which can make home ownership more affordable for you, as well as quicker, since you do not need to save up that lump sum for a down payment.

VA Home Loans also offer competitive interest rates. Plus, with the VA’s requirements regarding closing costs, the closing costs can be lower than with other types of mortgages.

Like conventional mortgages, a VA Home Loan can cover different property types that you would like to have as your primary residence. This can include single-family homes, condos, manufactured homes, and new construction.

The VA also offers support and financial counseling for recipients of VA Home Loans if you find that you are having trouble making payments. This gives you a built-in support system if you ever run into financial troubles.

What are the Limits?

One of the big limits on VA Home Loans is that they are only for homes that are your primary residence. This means that vacation homes and investment properties cannot be financed through a VA Home Loan.

If you are interested in a fixer-upper, you may also run into issues, depending on the condition of the home. A VA-approved appraiser must evaluate the home that you want to purchase. If that home’s condition does not meet the requirements which are currently in place for the value and condition of the home, you may not be able to finance that property with a VA Home Loan.

As of 2020, the VA has changed its rules to generally remove limits to the overall cost of the home for new loans for applicants who have full entitlement. If you do not have full entitlement, for example, if you have ever had a VA Home Loan that you defaulted on, some of those limits regarding how much of a home loan the VA will back may still apply to you. This is something that your lending specialist can discuss with you regarding your specific situation.

VA Home Loans also have a unique fee that is paid to the VA to cover program costs and keep this system available for future generations. This fee is called the VA Funding Fee. This fee can range between 1.4 percent to 3.6 percent of the loan depending on factors like whether you opt to have a down payment. You can either pay this fee upfront or in most cases make arrangements to wrap the fee into the loan amount so that you pay the fee off over the course of your VA Home Loan.

What about Refinancing?

If you used a VA Home Loan for your initial home loan, you may be eligible for an interest rate reduction refinance loan (IRRRL), to let you continue to take advantage of the great benefits of a VA Home Loan while lowering your interest. Just like a regular VA Home Loan, you will have to meet those requirements for service to be eligible to refinance. Currently, refinancing using this program is limited to customers whose original loan is a VA Home Loan which has a higher interest rate than what is currently available.

Is this a One Time Option?

No! If you need to purchase a new home, whether you are moving to a new area or if your family has outgrown your current home, a VA Home Loan for your new primary residence can be an option. If you have paid off the first VA Home Loan, the process is relatively simple since you are just applying for a new VA Home Loan. If you are still making payments on your first home, that process is a little more complicated, but your lender can easily walk you through how that will impact both applying for your new VA Home Loan and the terms of that new VA Home Loan.

Where can I get a VA Home Loan?

Many private lending companies and banks across the USA work with the VA to issue VA Backed Home Loans. This gives you a lot of flexibility to find someone local who can work with you and is familiar with the market in your area. While it is possible to use either a direct route through the VA or a large company like Veterans United, at Kansas City Mortgage Guy, we recommend finding someone local who can get to know you and your goals. Shopping around also gives you a chance to compare what different companies can offer you for interest rates and options for closing costs to get the best deal on this big purchase.

How can Kansas City Mortgage Guy help me get a VA Home Loan?

If you are a veteran or an eligible spouse, are you are interested in a VA Home Loan or in refinancing with an interest rate reduction refinance loan (IRRRL), please consider Kansas City Mortgage Guy! Our quick and convenient loan application is available on our homepage. This application is free and without any obligation on your part. If you still have questions before you are ready to apply, contact us so that we can get you the answers you need to take the next step toward home ownership!

AUTHOR BIO

Will Foster | First State Bank Mortgage Senior Loan Officer

I became a mortgage lender in 2010, right after the "bubble" popped, and the mortgage industry underwent an incredible transformation. This has given me a unique advantage in the fact that I have never known anything other than the highly-regulated world we now live in.

Throughout my years of experience, my primary goal has been to keep up with the constant changes in the industry so I can help my clients investigate all of their options and maximize savings. In addition, because I specialize in Conventional, FHA, USDA, Jumbo, portfolio, and VA refinances and purchases, I can help a wider variety of individuals, families, and investors identify and secure the right loan to best suit their future interests.

The mortgage process can be a little confusing and even overwhelming these days with all of the regulations. I guide my clients through the process from start to finish, and I try and make it as painless and hassle-free as possible.